RESP

What is a Registered Education Savings Plan (RESP)?

A Registered Education Savings Plan (RESP) allows parents and guardians to accumulate the necessary funds to finance a child’s post-secondary education.

The federal government allows you to accumulate investment income on a tax-sheltered basis until the funds are withdrawn.

Who can open an RESP?

Anyone who has an interest in providing a child with funds for their education!

- Parents

- Legal Parents

- Grandparents

- Friends

Who is eligible?

To qualify for an RESP, a beneficiary must:

- Be a Canadian resident

- Have a valid Social Insurance Number (SIN)

Advantages

As an incentive for parents to contribute to their child’s post-secondary education, the federal government offers two funding mechanisms. Investments grows tax free until a withdrawal is made.

-

Canada Education Savings Grant

Pays up to 20% of a child’s annual contribution up to an annual maximum of $500 or a lifetime maximum of $7200 until the beneficiary reaches the age of 17

-

Canada Learning Bond

Pays $500 plus an extra $100 per year up to the age of 15 to beneficiaries who were born after December 31st, 2003.

-

Additional matching grants for low incomers

Families with net annual incomes of less than $49, 020

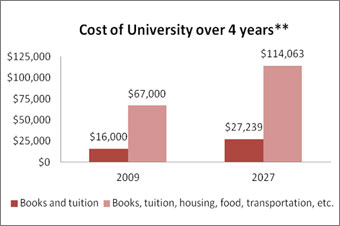

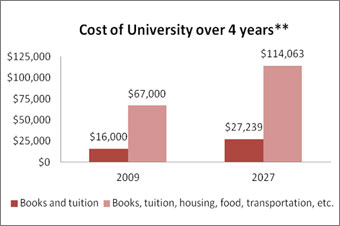

The cost of Post-Secondary school

Projections for an average student’s tuition fees and cost of living away from home have been projected to reach $118,010 in 2030. The illustration shows how the cost of living increases over time. Statistics Canada revealed that university tuition fees have risen 135% in the past 10 years

Sources: Canada Revenue Agency, Investopedia, Statistics Canada.

Contact a 3i Financial Group Advisor today to see how an RESP can help you save for your child’s education.